Getting Control of Your Finances

Select a country below to read the localised content of this article.

Please select your country…Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and save each year. Extra savings can be used to pay off any debts you might have, put them towards your pension, save for a deposit or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you, not just with your pension but your overall financial wellbeing.

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

To work out how to create a budget try our tool: https://bbt.amsretirement.co.uk/budgetplanner

Budget planner

The Government website Money and Pension Service has some great tools to help you create a budget and find ways of saving money www.moneyadviceservice.org.uk. Search for the ‘quick cash finder’ to put you in control of your household spending and analyse your results to help you take control of your money.

If you are trying to save money, why not try the Quick cash finder https://www.moneyadviceservice.org.uk/en/tools/quick-cash-finder.

The content of this article does not constitute individual financial advice.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and save each year. Extra savings can be used to pay off any debts you might have, put them towards your pension, save for a deposit or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you, not just with your pension but your overall financial wellbeing.

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

Budget planner

The Competition and Consumer Protection Commission (CCPC) website has some great tools to help you create a budget and find ways of saving money. To work out how to create a budget try https://www.ccpc.ie/consumers/tools-and-calculators/budget-planner/.

The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Are you all set for the year ahead? The end of the financial year is the cue for most of us to look at our financial position and get off to a flying start when it comes to our finances. Hopefully you’ve set some goals and made some progress towards them. However anytime is really a good time to get control of your finances. In case you find that your expenses are trending higher than you’d like or—shock, horror! —higher than your income, this could be the perfect time for a fiscal makeover. The starting point is gathering up as much information around your spending as possible, starting with doing up your personal budget. We all spend crazy hours at work, managing towards our company’s budget. If it’s too hard, take a budget snapshot starting with your bank account statement or credit card statement. You really can’t set realistic financial goals and savings targets without knowing how your cashflow looks like and how much money you have at your disposal.

Once you understand your total spending, deduct your total expenses from total income. Whatever is left is what you have to work with. Any surplus cashflow could be used to reduce your debts or even kick start a regular savings plan. If you discover you don’t have any surplus income and have a budget black hole; identify areas where you are overspending and can cut back on. Another way of managing is this is identifying your needs versus your wants.

Needs are the must have items, that is the necessary things you spend your money on such as housing, electricity and food. Wants are the discretionary items or your “nice to haves”; clothing, entertainment and travel.

Another smart strategy is to “Pay Yourself First”. Do you manage to save anything throughout the year or are you are constantly relying on this month’s income to pay last month’s credit card bills? Do you spend first? Then rely on what’s left over and hope to save it? Get in the habit of paying yourself first, that is directing a percentage of your income to a hard to access bank account, at least to begin with. If you are really disciplined, you can direct this amount to a regular savings plan. Setting up a weekly or monthly direct debit (ideally matching the frequency of when you are paid your salary) you will remove temptation and set up the discipline to live within your means and save some money! Imagine that!

Another area to think about is how you are managing your debt. Review your home loans regularly. If you have a mortgage this is likely to be your biggest monthly expense so it’s a good idea to check how it is structured at least once a year. Go online and compare interest rates. If your rate is no longer competitive ring your lender to discuss the options and consider switching loan providers if your existing provider doesn’t offer competitive rates. Be aware of any exit fees and implications of shifting your loan from one provider the next.

How you manage your credit card debt is also important. Make sure you pay your credit cards off by the due date and within the interest free period. Credit card debt attracts extremely high interest and should be managed carefully.

Other everyday expense areas worth reviewing are your electricity, phone, internet and insurances. You need to ask to get a good deal! Before you do, ensure you understand what your current plan/policy covers and research what’s on offer elsewhere. Make a practice of doing this once a year, when your plan or policy is due for renewal. The savings over the longer term can be substantial and can be put to much better use reducing debt or growing your wealth.

Reviewing the basics and understanding your current position is really important when it comes to getting ahead of your finances. It’s not rocket science, but it takes some patience, allocating a regular time slot and some discipline!

Disclaimer: The information is brought to you by Aon Singapore Pte Ltd, registration number 198301525W. Aon Singapore Pte Ltd is a registered insurance broker and exempt financial adviser regulated by the Monetary Authority of Singapore. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Do financial matters cause you stress? Do you spend more than you earn? Are you struggling to make each pay cheque last until the next?

There is no time like the present – now is as good a time as any to conduct a financial makeover or check progress against your financial goals. A full makeover will take some time, but it will be worth it.

The starting point is gathering as much information as possible and using a budget planner. Collect information on your monthly income (salary and other sources) and monthly expenses. This will generally be available from your financial statements such as bank account, investment account and Octopus account. Make sure you check all incomes sources and expenses. Remember to include one off expenses such as gifts and taxes!

With a budget planner, you will be able to see easily if you are spending more or less than you earn. Warning: the results may be shocking! Deduct your total monthly spending from total monthly income and what’s left is what you have to work with. Any surplus could be saved or invested. Set realistic savings goals and track progress regularly. If you discover that you are spending more than you earn, identify areas where you are overspending and could cut back. This could mean lifestyle changes also e.g. taking MTR instead of taxi.

An example budget planner to get you started may be found here -https://www.thechinfamily.hk/tools/en/budget.html

Disclaimer: The information is brought to you by Aon Hong Kong Limited. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent later. You should always consult primary or more accurate or more up-to-date sources of information.

Every end of a financial year it is good to look at our financial position and get off to a flying start when it comes to our finances. Hopefully you’ve set some goals and made some progress towards them. However anytime is really a good time to get control of your finances.

What does being in control of your finances mean? It’s a combination of understanding where you stand financially, spending less than you earn and having confidence in your ability to make financial decisions (with or without the help of a trusted financial professional). In case you find that your expenses are trending higher than your income, to reduce stress and anxiety over your finances, this could be the perfect time for a financial makeover.

Spend less than you earn. The starting point is gathering as much information of what you have coming in (income) and what is going out (expense). You really can’t set realistic financial goals and savings targets without knowing how your cashflow looks like and how much money you have at your disposal. Not knowing these two numbers can lead to undue stress and anxiety and a lack of control over your money. Plan ahead to ensure you have the cash to cover expenses when they arise. A cash flow snapshot will help you with that process. There are only three ways to fix a cash flow shortage: 1) earn more money, 2) spend less, or 3) a combination of 1 & 2.

Earn more. Another smart strategy is to “Pay Yourself First”. Do you manage to save anything throughout the year or are you constantly relying on this month’s income to pay last month’s credit card bills? Do you spend first then rely on what is left over and hope to save it? Get in the habit of paying yourself first, that is, directing a percentage of your income to a bank account, at least to begin with. If you are disciplined, you can direct this amount to a regular savings plan. Setting up a weekly or monthly direct debit (ideally matching the frequency of when you are paid your salary) you will remove temptation and set up the discipline to live within your means and save some money!

Set goals. What do you want to accomplish? Think big! If you don't set a goal, you are unlikely to achieve it. Commonly, people want to pay off debt, save for the future, set aside funds for a child's education, retire at a certain age or take the family on a vacation. This is great, but goals need to be more specific; if retirement savings is your goal, you need to decide at what age you want to retire and how much income per year you want. Work with a financial planner or advisor to help brainstorm goals and build a plan to achieve your specific goals.

People tend to stress over money and finances and often put off looking at their financial situation. It's not as complicated as people think. Work with a professional to help simplify your finances and help you feel in control. Simply put, being in control is nothing more than having an awareness of your financial situation and take action to achieve your goals. What are you waiting for?

Disclaimer: The information is brought to you by Aon Insurance & Reinsurance Brokers Philippines Inc., registration number 96590. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

Are you all set for the year ahead? The end of the financial year is the cue for most of us to look at our financial position and get off to a flying start when it comes to our finances. Hopefully you’ve set some goals and made some progress towards them. However anytime is really a good time to get control of your finances. In case you find that your expenses are trending higher than you’d like or—shock, horror! —higher than your income, this could be the perfect time for a fiscal makeover. The starting point is gathering up as much information around your spending as possible, starting with doing up your personal budget. We all spend crazy hours at work, managing towards our company’s budget. If it’s too hard, take a budget snapshot starting with your bank account statement or credit card statement. You really can’t set realistic financial goals and savings targets without knowing how your cashflow looks like and how much money you have at your disposal.

Once you understand your total spending, deduct your total expenses from total income. Whatever is left is what you have to work with. Any surplus cashflow could be used to reduce your debts or even kick start a regular savings plan. If you discover you don’t have any surplus income and have a budget black hole; identify areas where you are overspending and can cut back on. Another way of managing is this is identifying your needs versus your wants.

Needs are the must have items, that is the necessary things you spend your money on such as housing, electricity and food. Wants are the discretionary items or your “nice to haves”; clothing, entertainment and travel.

Another smart strategy is to “Pay Yourself First”. Do you manage to save anything throughout the year or are you are constantly relying on this month’s income to pay last month’s credit card bills? Do you spend first? Then rely on what’s left over and hope to save it? Get in the habit of paying yourself first, that is directing a percentage of your income to a hard to access bank account, at least to begin with. If you are really disciplined, you can direct this amount to a regular savings plan. Setting up a weekly or monthly direct debit (ideally matching the frequency of when you are paid your salary) you will remove temptation and set up the discipline to live within your means and save some money! Imagine that!

Another area to think about is how you are managing your debt. Review your home loans regularly. If you have a mortgage this is likely to be your biggest monthly expense so it’s a good idea to check how its structured at least once a year. Go online and compare interest rates. If your rate is no longer competitive ring your lender to discuss the options and consider switching loan providers if your existing provider doesn’t offer competitive rates. Be aware of any exit fees and implications of shifting your loan from one provider the next.

How you manage your credit card debt is also important. Make sure you pay your credit cards off by the due date and within the interest free period. Credit card debt attracts extremely high interest and should be managed carefully.

Other everyday expense areas worth reviewing are your electricity, phone, internet and insurances. You need to ask to get a good deal! Before you do, ensure you understand what your current plan/policy covers and research what’s on offer elsewhere. Make a practice of doing this once a year when your plan or policy is due for renewal. The savings over the longer term can be substantial and can be put to much better use reducing debt or growing your wealth.

Reviewing the basics and understanding your current position is really important when it comes to getting ahead of your finances. It’s not rocket science, but it takes some patience, allocating a regular time slot and some discipline!

Disclaimer: The information is brought to you by Aon Hewitt Consulting (Shanghai) Co. Ltd. registration number 310000400102466. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information.

您为来年做好准备了吗?一个财政年度结束时,我们大多数人都会审视自己的财务状况,并希望下一年在财务方面有一个良好的开端。希望您已经设定了一些目标,并在实现目标的路上取得了一些进展。不过,任何时候开始掌控财务都不算晚。一旦发现您的支出比想象中要多,或者超过您的收入,您可能会感到震惊、恐惧,而这就是财务大改造的最佳时机。财务改造的出发点是尽可能多地收集关于自己消费的信息,从加总个人花销开始。我们每天可能只顾着埋头工作,努力达到公司的业绩指标,却很少抽时间算算自己的钱。如果很难计算自己的花销,您可以根据银行卡账单或信用卡账单大致了解自己的开销。如果您不知道自己的现金流是什么样的、有多少钱可供支配,您就无法设定切实的财务目标和储蓄目标。

一旦您了解了自己的总开销,从您的总收入中减去总支出,剩下的钱就是需要您管理的。任何剩余的现金流都可以用来减少您的债务,或者启动一项定期储蓄计划。如果您发现自己没有任何剩余收入,并且有一个预算黑洞,那么您需要找出您超支和可以削减开支的地方。另一种财务管理方式是识别您需要的和您想要的东西。

您需要的东西指生活必需品,比如房屋、水电和食物。您想要的东西是您可以自行决定是否购买或者希望拥有的物品,比如新衣服、娱乐活动和旅游。

另一个明智的策略是“先付钱给自己”。您一整年都在想办法存钱吗?还是您一直等着这个月的工资来支付上个月的信用卡账单?您会先疯狂消费,然后靠剩下的钱紧巴巴地生活并希望存下一笔钱吗?那么,您需要养成先付钱给自己的习惯,也就是将您收入的一部分存入一个很难取出的银行账户,至少一开始是这样。如果您真的很自律,您也可以把这笔钱存入一个常规的储蓄计划账户。建立一个按周或按月的直接扣款计划(最好与您薪水入账的频率相匹配),您将会摆脱诱惑,养成量入为出的习惯,从而存下一笔钱。想象一下!

另一个需要考虑的方面是您如何管理您的债务。定期检查您的住房贷款。如果您有抵押贷款,这可能是您每月最大的一笔开销,所以应该每年至少检查一次贷款结构。上网比较贷款利率。如果您的利率不再有竞争力,打电话给您的银行,讨论其他利率方案,如果您现有的贷款行不能提供有竞争力的利率,考虑换一家银行。这时要注意任何违约费用和从一家银行转移到下一家银行对贷款的影响。

如何管理您的信用卡债务也很重要。确保在到期日前和免息期内还清您的信用卡。信用卡逾期利息非常高,应该认真管理。

其他值得评估的日常开支领域是您的水电费、电话费、上网费和保险费。要多问,才能省钱!咨询之前,请确保自己了解当前的缴费计划/保险范围,并研究其他公司的同类产品。这样的咨询每年应该进行一次,比如当您的缴费或保险合同快到期时就可以开始咨询。从长远来看,这样可以省下很多钱,而这些钱可以更好地用于减少债务或增加财富。

审查自己的基本开支并了解自己当前的财务状况对于正确理财非常重要。这并非难事,但需要一点耐心、抽出一些固定的理财时间,以及自律!

免责声明:以上信息由怡安翰威特咨询(上海)有限公司(注册号310000400102466)提供。由于未考虑可能接收该信息的任何特定人士的具体投资目标、财务状况或特殊需求,因此,上述信息不能代替针对个别情况的具体建议。在您决定购买某投资产品之前,请考虑您的具体投资目标、财务状况或特殊需求,并向理财顾问咨询相关投资产品的适用性。此外,建议您在必要时获取其他专业建议。以上信息出于善意提供,在汇编时确认准确。我司无义务在今后更新相关信息或更正发现的不准确信息。用户应不时查阅各种信息来源,以获取准确的最新一手信息。

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

En cada fin de año financiero es bueno revisar su situación financiera y comenzar de cero cuando se trate de nuestras finanzas. Esperamos que las metas establecidas hayan progresado. No obstante, siempre es un bueno momento para controlar sus finanzas.

¿Qué significa ‘controlar sus finanzas’? Es una combinación entre entender su posición financiera, gastando menos de lo que gana y tener confianza en su capacidad de tomar decisiones financieras (con o sin la ayuda de un profesional financiero de confianza). En el caso que usted descubra que las tendencias de sus gastos son más altas que su renta, para reducir el estrés y la ansiedad con relación a sus finanzas, este puede ser el momento perfecto para una reestructuración financiera.

Gaste menos de lo que usted gana. El punto de partida es recolectar el máximo de informaciones sobre lo que usted recibe (ingresos) y sobre lo que es gastado (gastos). No se pueden definir metas financieras y de economía realistas sin saber si ellas respetan su flujo de caja y cuánto dinero usted tiene a su disposición. El desconocimiento de estos dos números puede causar estrés y ansiedad innecesarios y falta de control sobre su dinero. Haga planificaciones para estar seguro de que usted tiene el dinero para cubrir sus gastos cuando ellos surjan. Analizar el flujo de caja le ayudará en este proceso. Hay solamente 3 medios de corregir una escasez de flujo de caja: 1) ganar más dinero, 2) gastar menos, o 3) la combinación de las alternativas 1 y 2.

Ganar más dinero Otra estrategia inteligente es “Páguese primero”. ¿Usted logra ahorrar algo a lo largo del año o está siempre dependiendo de la renta del mes para pagar la factura de la tarjeta de crédito del mes anterior? ¿Usted gasta primero y después depende de lo que sobra y espera que sobre algo para guardar? Habitúese a ‘pagarse’ primero, o sea, redireccione un porcentaje de su renta para una cuenta bancaria, solo para comenzar. Si tiene disciplina, usted puede redireccionar esa cuantía a una cuenta de ahorro regular. ¡Al establecer un débito directo semanal o mensual (de preferencia que corresponda a la frecuencia de cuando usted recibe) no se sentirá tentado y tendrá una disciplina para vivir por sus propios medios y ahorrar un poco de dinero!

Establecer metas. ¿Qué usted quiere lograr? ¡Piense alto! Si usted no establece una meta, es poco probable que usted logre algo. Generalmente, las personas quieren pagar sus deudas, ahorrar para el futuro, crear un fondo para la educación de sus hijos, jubilarse a una determinada edad o salir de vacaciones con su familia. Esto es excelente, pero las metas deben ser más específicas; si su meta es ahorrar para jubilarse, usted debe decidir a qué edad desea jubilarse y cuánto de renta por año desea. Haga esto con la ayuda de un planificador o consultor financiero y cree un plan para alcanzar tales metas.

Las personas tienden a estresarse por causa del dinero y de las finanzas y muchas veces dejan de analizar su situación financiera. No es tan complicado como las personas creen que es. Trabaje con un profesional para ayudarle a simplificar sus finanzas y ayudarle a sentirse en el control. De forma simple, estar en control no es nada más que tener la consciencia de su situación financiera y actuar para alcanzar sus metas. ¿Qué usted está esperando?

Aviso Legal: Estas informaciones fueron provenientes por Aon y sus Afiliadas. Las informaciones no consideran las metas específicas de inversión, situación financiera o necesidades particulares de ninguna persona en especial que pueda estar recibiendo los materiales. Consecuentemente, ellas no pueden depender o ser tratadas como sustitutas para situaciones individuales relacionadas a un consejo específico. Busque la ayuda de un consultor financiero con relación a la adecuación de cualquier inversión teniendo en cuenta sus metas específicas de inversión, situación financiera o necesidades especiales antes de comprometerse en la compra de producto de inversión. También recomendamos que, siempre que sea apropiado, se aconseje con otros profesionales. Las informaciones son suministradas de buena fe y con la confianza de que son precisas en el momento en que fueron suministradas. No tenemos la obligación de actualizar los materiales o corregir ninguna imprecisión que pueda ser aparente posteriormente. Siempre consulte a su fuente primaria, más precisa y actualizada de informaciones.

En cada fin de año financiero es bueno revisar su situación financiera y comenzar de cero cuando se trate de nuestras finanzas. Esperamos que las metas establecidas hayan progresado. No obstante, siempre es un bueno momento para controlar sus finanzas.

¿Qué significa ‘controlar sus finanzas’? Es una combinación entre entender su posición financiera, gastando menos de lo que gana y tener confianza en su capacidad de tomar decisiones financieras (con o sin la ayuda de un profesional financiero de confianza). En el caso que usted descubra que las tendencias de sus gastos son más altas que su renta, para reducir el estrés y la ansiedad con relación a sus finanzas, este puede ser el momento perfecto para una reestructuración financiera.

Gaste menos de lo que usted gana. El punto de partida es recolectar el máximo de informaciones sobre lo que usted recibe (ingresos) y sobre lo que es gastado (gastos). No se pueden definir metas financieras y de economía realistas sin saber si ellas respetan su flujo de caja y cuánto dinero usted tiene a su disposición. El desconocimiento de estos dos números puede causar estrés y ansiedad innecesarios y falta de control sobre su dinero. Haga planificaciones para estar seguro de que usted tiene el dinero para cubrir sus gastos cuando ellos surjan. Analizar el flujo de caja le ayudará en este proceso. Hay solamente 3 medios de corregir una escasez de flujo de caja: 1) ganar más dinero, 2) gastar menos, o 3) la combinación de las alternativas 1 y 2.

Ganar más dinero Otra estrategia inteligente es “Páguese primero”. ¿Usted logra ahorrar algo a lo largo del año o está siempre dependiendo de la renta del mes para pagar la factura de la tarjeta de crédito del mes anterior? ¿Usted gasta primero y después depende de lo que sobra y espera que sobre algo para guardar? Habitúese a ‘pagarse’ primero, o sea, redireccione un porcentaje de su renta para una cuenta bancaria, solo para comenzar. Si tiene disciplina, usted puede redireccionar esa cuantía a una cuenta de ahorro regular. ¡Al establecer un débito directo semanal o mensual (de preferencia que corresponda a la frecuencia de cuando usted recibe) no se sentirá tentado y tendrá una disciplina para vivir por sus propios medios y ahorrar un poco de dinero!

Establecer metas. ¿Qué usted quiere lograr? ¡Piense alto! Si usted no establece una meta, es poco probable que usted logre algo. Generalmente, las personas quieren pagar sus deudas, ahorrar para el futuro, crear un fondo para la educación de sus hijos, jubilarse a una determinada edad o salir de vacaciones con su familia. Esto es excelente, pero las metas deben ser más específicas; si su meta es ahorrar para jubilarse, usted debe decidir a qué edad desea jubilarse y cuánto de renta por año desea. Haga esto con la ayuda de un planificador o consultor financiero y cree un plan para alcanzar tales metas.

Las personas tienden a estresarse por causa del dinero y de las finanzas y muchas veces dejan de analizar su situación financiera. No es tan complicado como las personas creen que es. Trabaje con un profesional para ayudarle a simplificar sus finanzas y ayudarle a sentirse en el control. De forma simple, estar en control no es nada más que tener la consciencia de su situación financiera y actuar para alcanzar sus metas. ¿Qué usted está esperando?

Aviso Legal: Estas informaciones fueron provenientes por Aon y sus Afiliadas. Las informaciones no consideran las metas específicas de inversión, situación financiera o necesidades particulares de ninguna persona en especial que pueda estar recibiendo los materiales. Consecuentemente, ellas no pueden depender o ser tratadas como sustitutas para situaciones individuales relacionadas a un consejo específico. Busque la ayuda de un consultor financiero con relación a la adecuación de cualquier inversión teniendo en cuenta sus metas específicas de inversión, situación financiera o necesidades especiales antes de comprometerse en la compra de producto de inversión. También recomendamos que, siempre que sea apropiado, se aconseje con otros profesionales. Las informaciones son suministradas de buena fe y con la confianza de que son precisas en el momento en que fueron suministradas. No tenemos la obligación de actualizar los materiales o corregir ninguna imprecisión que pueda ser aparente posteriormente. Siempre consulte a su fuente primaria, más precisa y actualizada de informaciones.

En cada fin de año financiero es bueno revisar su situación financiera y comenzar de cero cuando se trate de nuestras finanzas. Esperamos que las metas establecidas hayan progresado. No obstante, siempre es un bueno momento para controlar sus finanzas.

¿Qué significa ‘controlar sus finanzas’? Es una combinación entre entender su posición financiera, gastando menos de lo que gana y tener confianza en su capacidad de tomar decisiones financieras (con o sin la ayuda de un profesional financiero de confianza). En el caso que usted descubra que las tendencias de sus gastos son más altas que su renta, para reducir el estrés y la ansiedad con relación a sus finanzas, este puede ser el momento perfecto para una reestructuración financiera.

Gaste menos de lo que usted gana. El punto de partida es recolectar el máximo de informaciones sobre lo que usted recibe (ingresos) y sobre lo que es gastado (gastos). No se pueden definir metas financieras y de economía realistas sin saber si ellas respetan su flujo de caja y cuánto dinero usted tiene a su disposición. El desconocimiento de estos dos números puede causar estrés y ansiedad innecesarios y falta de control sobre su dinero. Haga planificaciones para estar seguro de que usted tiene el dinero para cubrir sus gastos cuando ellos surjan. Analizar el flujo de caja le ayudará en este proceso. Hay solamente 3 medios de corregir una escasez de flujo de caja: 1) ganar más dinero, 2) gastar menos, o 3) la combinación de las alternativas 1 y 2.

Ganar más dinero Otra estrategia inteligente es “Páguese primero”. ¿Usted logra ahorrar algo a lo largo del año o está siempre dependiendo de la renta del mes para pagar la factura de la tarjeta de crédito del mes anterior? ¿Usted gasta primero y después depende de lo que sobra y espera que sobre algo para guardar? Habitúese a ‘pagarse’ primero, o sea, redireccione un porcentaje de su renta para una cuenta bancaria, solo para comenzar. Si tiene disciplina, usted puede redireccionar esa cuantía a una cuenta de ahorro regular. ¡Al establecer un débito directo semanal o mensual (de preferencia que corresponda a la frecuencia de cuando usted recibe) no se sentirá tentado y tendrá una disciplina para vivir por sus propios medios y ahorrar un poco de dinero!

Establecer metas. ¿Qué usted quiere lograr? ¡Piense alto! Si usted no establece una meta, es poco probable que usted logre algo. Generalmente, las personas quieren pagar sus deudas, ahorrar para el futuro, crear un fondo para la educación de sus hijos, jubilarse a una determinada edad o salir de vacaciones con su familia. Esto es excelente, pero las metas deben ser más específicas; si su meta es ahorrar para jubilarse, usted debe decidir a qué edad desea jubilarse y cuánto de renta por año desea. Haga esto con la ayuda de un planificador o consultor financiero y cree un plan para alcanzar tales metas.

Las personas tienden a estresarse por causa del dinero y de las finanzas y muchas veces dejan de analizar su situación financiera. No es tan complicado como las personas creen que es. Trabaje con un profesional para ayudarle a simplificar sus finanzas y ayudarle a sentirse en el control. De forma simple, estar en control no es nada más que tener la consciencia de su situación financiera y actuar para alcanzar sus metas. ¿Qué usted está esperando?

Aviso Legal: Estas informaciones fueron provenientes por Aon y sus Afiliadas. Las informaciones no consideran las metas específicas de inversión, situación financiera o necesidades particulares de ninguna persona en especial que pueda estar recibiendo los materiales. Consecuentemente, ellas no pueden depender o ser tratadas como sustitutas para situaciones individuales relacionadas a un consejo específico. Busque la ayuda de un consultor financiero con relación a la adecuación de cualquier inversión teniendo en cuenta sus metas específicas de inversión, situación financiera o necesidades especiales antes de comprometerse en la compra de producto de inversión. También recomendamos que, siempre que sea apropiado, se aconseje con otros profesionales. Las informaciones son suministradas de buena fe y con la confianza de que son precisas en el momento en que fueron suministradas. No tenemos la obligación de actualizar los materiales o corregir ninguna imprecisión que pueda ser aparente posteriormente. Siempre consulte a su fuente primaria, más precisa y actualizada de informaciones.

Em cada fim de ano financeiro é bom rever sua situação financeira e começar do zero quando se trata de nossas finanças. Esperamos que as metas estabelecidas tenham progredido. No entanto, sempre é um bom momento para controlar suas finanças.

O que significa ‘controlar suas finanças’? É uma combinação entre entender sua posição financeira, gastando menos do que ganha e ter confiança na sua capacidade de tomar decisões financeiras (com ou sem a ajuda de um profissional financeiro de confiança). Caso você descubra que a tendência de suas despesas são mais altas do que sua renda, para reduzir o estresse e a ansiedade em relação às suas finanças, esse pode ser o momento perfeito para uma reestruturação financeira.

Gaste menos do que você ganha. O ponto de partida é coletar o máximo de informações sobre o que você recebe (receita) e o sobre que é gasto (despesa). Não dá para definir metas financeiras e de economia realistas sem saber se elas comportam seu fluxo de caixa e quanto de dinheiro você tem à sua disposição. O não conhecimento desses dois números pode causar estresse e ansiedade desnecessários e falta de controle sobre o seu dinheiro. Faça planejamentos para ter certeza que você tem o dinheiro para cobrir as despesas quando elas surgirem. Analisar o fluxo de caixa o ajudará nesse processo. Há apenas 3 meios de corrigir uma escassez de fluxo de caixa: 1) ganhar mais dinheiro, 2) gastar menos, ou 3) a combinação das alternativas 1 e 2.

Ganhar mais dinheiro Outra estratégia inteligente é a de “Pague-se primeiro”. Você consegue economizar alguma coisa ao longo do ano ou está sempre dependendo da renda do mês para pagar a fatura do cartão de crédito do mês anterior? Você gasta primeiro e depois depende do que sobra e espera sobre algo para guardar? Habitue-se a ‘se pagar’ primeiro, ou seja, redirecione uma porcentagem da sua renda para uma conta bancária, só para começar. Se você tiver disciplina, você pode redirecionar essa quantia a um plano de poupança regular. Ao estabelecer um debito direto semanal ou mensal (de preferência que corresponda à frequência de quando você recebe) você não se sentirá tentado e terá uma disciplina para viver por seus próprios meios e economizar um pouco de dinheiro!

Estabelecer metas. O que você quer conseguir? Pense alto! Se você não estabelecer uma meta, é improvável que você consiga algo. Geralmente, as pessoas querem pagar suas dívidas, economizar para o futuro, criar um fundo para a educação dos filhos, se aposentar a uma determinada idade ou sair de férias com a família. Isso é ótimo, mas as metas precisam ser mais específicas; se a sua meta é economizar para se aposentar, você precisa decidir em que idade deseja se aposentar e quanto de renda por ano deseja. Faça isso com a ajuda de um planejador ou consultor financeiro e crie um plano para atingir tais metas.

As pessoas tendem a se estressar por conta do dinheiro e das finanças e muitas vezes deixam de analisar sua situação financeira. Não é tão complicado como as pessoas acham que é. Trabalhe com um profissional para ajudar a simplificar suas finanças e ajudá-lo a se sentir no controle. De forma simples, estar no controle não é nada mais do que ter a consciência de sua situação financeira e agir para atingir suas metas. O que você está esperando?

Aviso Legal: Estas informações foram provenientes da Aon Holdings Corretores de Seguros LTDA. As informações não consideram as metas específicas de investimento, situação financeira ou necessidades particulares de qualquer pessoa em especial que possa estar recebendo os materiais. Consequentemente, elas não podem depender ou serem tratadas como substitutas para situações individuais relacionadas a um conselho específico. Procure o auxílio de um consultor financeiro em relação à adequação de qualquer investimento levando em conta suas metas específicas de investimento, situação financeira ou necessidades especiais antes de se comprometer na compra de produto de investimento. Também recomendamos que, sempre que apropriado, aconselhe-se com outros profissionais. As informações são fornecidas de boa fé e com a confiança de que são precisas no momento em que foram fornecidas. Não temos a obrigação de atualizar os materiais ou corrigir qualquer imprecisão que possa ficar aparente posteriormente. Sempre consulte sua fonte primária, mais precisa e atualizada de informações.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt/Loans

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

Author is not a financial advisor, tax professional or legal advisor. The article and its content is for informational purposes only, reader should not construe any such information or other material as legal, tax, investment, financial, or other advice. All information, data, strategies, reports, articles and all other features of this article are provided for informational and educational purposes only and should not be considered or inferred as personalized investment advice. Article may contain errors, and the reader should not make any financial or investment decision based solely on what the reader reads in this article and writing. It shall be reader’s responsibility to perform its own due diligence, and reader must make its own decisions. Be advised and aware that financial and investment decisions involve risk. Author accept no liability whatsoever for any direct or consequential loss arising from any use of author’s writings, products, services, website, or other content, including contents of this article. Reader is responsible for its own investment research and decisions. Reader should seek the advice of a qualified investment advisor and fully understand any and all risks before investing or making any financial decision. Author make no representation that any reader will or is likely to experience results as cited in this article. All results of author’s recommendations are not based on actual investments by author and are based upon a hypothesis, available statistics and surveys which have limitations and do not reflect all components of actual investments. Reader’s actual results may vary based upon many factors. All content and references to third-party sources is provided solely for convenience. This information may be inaccurate, use at your own risk.

By reading this article or any of its contents you agree that neither author nor its employees, shareholders, directors, contractors, affiliates, agents, third party content providers or licensors will be liable for any direct, indirect, incidental or any other type of claim, liability, cost, damage or loss resulting from reader’s use of any of this content. This includes, but is not limited to, loss or injury caused in whole or in part by contingencies beyond our control.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt/Loans

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

The content of this article does not constitute individual financial advice.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt/Loans

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

The information in this report does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations.

While we have made every attempt to ensure that the information contained in this report has been obtained from reliable sources, Aon is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this report is provided "as is", with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability and fitness for a particular purpose. In no event will Aon be liable to you or anyone else for any decision made or action taken in reliance on the information in this report or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt/Loans

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

Det trenger ikke være vanskelig å ta kontroll over din egen økonomiske situasjon. Begynner du å ta styring over pengene dine, kan det være en veldig god investering. Du vil bli bedre til å ta grep om ditt eget pengeforbruk og kunne spare det du ikke bruker. Ekstra sparepenger kan brukes til å nedbetale gjeld, plasseres i langsiktige spareordninger til bruk ved uforutsette store utgifter, eller sparing til pensjon.

Dette handler om å utvikle gode vaner, planlegge, sette deg mål og gjennomgå finansene dine.

Disse åtte gode økonomiske vanene hjelper deg å ta kontroll over egen økonomi:

- Bruk mindre enn du tjener

- Sett deg inn i hvordan rentes rente fungerer.

- Sett deg inn i ulike typer gjeld.

- Invester planmessig i noe du har kunnskap om.

- Beskytt dine nærmeste.

- Sett deg inn i din arbeidsgivers pensjonsplan.

Contrôler votre situation financière ne doit pas nécessairement être laborieux. Commencer à gérer votre argent peut réellement s’avérer payant. Cela peut vous aider à maîtriser vos dépenses et à économiser de l’argent. Des économies supplémentaires peuvent servir à rembourser vos dettes éventuelles ou peuvent être venir grossir votre épargne à long terme afin de faire face à une dépense importante ou même de planifier vos prochaines vacances.

C’est simple, il suffit de développer de bonnes habitudes afin de planifier, de vous fixer des objectifs et de surveiller vos finances. Et la bonne nouvelle, c’est que vous trouverez tous les conseils pour y arriver ici.

Voici 8 bonnes habitudes qui vous aideront à prendre le contrôle :

- Dépensez moins que ce que vous gagnez ;

- Apprenez à comprendre le fonctionnement des intérêts composés ;

- Comprenez les différents types de dettes ;

- Investissez dans ce que vous comprenez et élaborez un plan ;

- Protégez ceux que vous aimez le plus ;

- Maîtrisez la fiscalité ;

- Comprenez les avantages sociaux octroyés par votre employeur.

Je financiële situatie onder controle krijgen hoeft niet ingewikkeld te zijn. Wanneer je je geld gaat beheren, kan dat echt de moeite lonen. Het kan je helpen je uitgaven onder controle te houden en je geld besparen. Extra besparingen kunnen worden gebruikt om eventuele schulden af te betalen, of ze kunnen bijdragen aan je langetermijnbesparingen voor een grote uitgave of zelfs gewoon om je volgende vakantie te plannen.

Het is eenvoudig. Het gaat om het ontwikkelen van gezonde gewoonten om te plannen, doelen te stellen en je financiën te herzien en het goede nieuws is dat je hier alle tips krijgt om je hiermee te helpen.

Hier volgen 8 goede gewoonten waarmee je je financiën onder controle kan krijgen;

- Geef minder uit dan je verdient

- Begrijp hoe samengestelde interest werkt

- Begrijp soorten schulden

- Investeer in wat je begrijpt en stel een plan op

- Bescherm je geliefden

- Begrijp belastingen

- Begrijp je arbeidsvoorwaarden

Det behøver ikke at være kompliceret at få styr på din økonomiske situation. Det kan virkeligt betale sig for dig at komme i gang med at forvalte dine penge. Det kan hjælpe dig til at holde styr på dit forbrug og samtidig hjælpe dig med at spare op. En ekstra opsparing kan bruges til at betale af på en eventuel gæld, eller du kan sætte dem ind på din langsigtede opsparing til en stor udgift i fremtiden – eller du kan også bare planlægge din næste ferie.

Det er ganske simpelt – det hele handler om at udvikle sunde vaner i forhold til at planlægge, fastsætte mål og gennemgå sin økonomi, og den gode nyhed er, at du har alle værktøjer, der kan hjælpe dig, lige ved hånden.

Her er 8 sunde vaner, der kan hjælpe dig med at få styr på din økonomi:

- Brug mindre, end du tjener

- Forstå hvordan rentes rente fungerer

- Forstå de forskellige gældtyper

- Investér i det, du forstår, og sørg for at have en plan

- Beskyt dem, du elsker mest

- Forstå skat

- Forstå dine overenskomstsikrede rettigheder

Η απόκτηση του ελέγχου της οικονομικής σας κατάστασης δεν χρειάζεται να είναι μια περίπλοκη διαδικασία. Αξίζει πραγματικά τον κόπο να αρχίσετε να διαχειρίζεστε τα χρήματά σας. Αυτό θα σας βοηθήσει να ελέγχετε τις δαπάνες σας και να κάνετε αποταμίευση. Τα επιπλέον χρήματα που αποταμιεύετε μπορούν να χρησιμοποιηθούν για την εξόφληση χρεών που τυχόν έχετε ή να τοποθετηθούν σε μακροπρόθεσμο αποταμιευτικό πρόγραμμα για την κάλυψη μιας σημαντικής δαπάνης ή ακόμα για να προγραμματίσετε τις επόμενες διακοπές σας.

Είναι απλό, ο στόχος είναι να μπορέσετε να αναπτύξετε «υγιεινές» συνήθειες προκειμένου να προγραμματίζετε, να θέτετε στόχους και να αξιολογείτε τα οικονομικά σας, ενώ τα καλά νέα είναι ότι έχετε άμεσα στη διάθεσή σας όλα τα εργαλεία που χρειάζεστε.

Παρουσιάζουμε τις 8 υγιεινές συνήθειες που θα σας βοηθήσουν να αποκτήσετε τον έλεγχο:

- Να ξοδεύετε λιγότερα χρήματα από όσα κερδίζετε

- Να κατανοείτε πώς λειτουργεί ο ανατοκισμός

- Να κατανοείτε τους τύπους χρέους

- Να πραγματοποιείτε επενδύσεις που κατανοείτε και να έχετε σχέδιο

- Να προστατεύετε τους αγαπημένους σας

- Να κατανοείτε τους φόρους

- Να κατανοείτε τις παροχές εργαζομένων που λαμβάνετε

Hacerse con el control de su situación financiera no tiene por qué ser complicado. Una vez que empiece a gestionar su dinero, pronto verá cómo sus esfuerzos se ven recompensados. Para empezar, hacerlo puede ayudarle a vigilar su nivel de gasto y a ahorrar. Más adelante, podrá usar ese dinero adicional para amortizar cualquier deuda que tenga, ahorrarlo a más largo plazo o destinarlo a una compra importante o a la reserva de sus próximas vacaciones.

El proceso es sencillo: se trata simplemente de desarrollar la buena costumbre de planificar, establecer objetivos y revisar sus finanzas, y lo mejor de todo es que ahora dispone de todas las herramientas necesarias para hacerlo.

A continuación le presentamos ocho hábitos positivos que le ayudarán a hacerse con el control:

- Gaste menos de lo que gana

- Entienda cómo funciona la capitalización compuesta de intereses

- Estudie los diferentes tipos de deuda

- Invierta solo en los productos que sea capaz de entender y trace un plan

- Proteja a sus seres queridos

- Conozca sus obligaciones fiscales

- Entérese de las prestaciones que le ofrece su empleador

A pénzügyi helyzeted feletti irányítást visszaszerezni nem feltétlenül bonyolult feladat. Ha elkezded kezelni a pénzed, az nagyon kifizetődő lehet. Segíthet, hogy odafigyelj a kiadásaidra, és pénzt spórolhatsz vele. A többletmegtakarítást használhatod az esetleges adósságaid kifizetésére, félreteheted hosszú távú megtakarítás formájában egy nagyobb kiadás esetére, vagy egyszerűen csak megtervezheted a következő nyaralásod.

Egyszerű, az egész arról szól, hogy egészséges szokásokat alakíts ki a tervezéssel, a célok meghatározásával és pénzügyeid áttekintésével kapcsolatban, a jó hír pedig az, hogy itt minden eszközt megtalálsz, ami ebben a segítségedre lehet.

Íme 8 egészséges szokás, amelyek segítenek, hogy átvedd az irányítást:

- Költs kevesebbet, mint amennyit keresel.

- Értsd meg, hogyan működik a kamatos kamat.

- Ismerd meg az adósságok típusait.

- Fektess abba, amit megértesz, és legyen terved.

- Védd meg azokat, akiket a legjobban szeretsz.

- Értsd meg az adóügyeket.

- Értsd meg a munkáltatói juttatásaidat.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

The content of this article does not constitute individual financial advice.

Reprendre le contrôle de votre situation financière n’est pas aussi compliqué que vous le pensez. Lorsque vous commencez à gérer votre argent, vous pouvez très rapidement en voir les bénéfices. Vous pourrez ainsi contrôler vos dépenses et réaliser des économies. Ces économies supplémentaires pourront servir à rembourser les dettes que vous pouvez avoir ou à compléter votre épargne à long terme pour une dépense plus conséquente ou encore simplement à organiser vos prochaines vacances.

Cela n’a rien de compliqué, il s’agit simplement de prendre des habitudes saines pour planifier, se fixer des objectifs et évaluer ses finances. La bonne nouvelle est que vous disposez de tous les outils nécessaires pour cela.

Voici les huit habitudes saines qui vous aideront à prendre le contrôle :

- Dépenser moins que ce que vous gagnez

- Comprendre le fonctionnement des intérêts composés

- Comprendre les types de dettes

- Investir dans des produits que vous comprenez et avoir un plan

- Protéger vos êtres chers

- Comprendre la fiscalité

- Comprendre les avantages offerts par votre employeur

Ihre Finanzen in den Griff zu bekommen, muss gar nicht kompliziert sein. Ein bewusster Umgang mit Geld kann sich buchstäblich für Sie auszahlen. Sie behalten den Überblick über Ihre Ausgaben und sparen Geld. Mit diesen zusätzlichen Einsparungen können Sie eventuell vorhandene Schulden tilgen, Sie können sie aber auch für ein langfristiges Sparziel oder den nächsten Urlaub zurücklegen.

Es ist ganz einfach, wenn Sie sich die richtigen Verhaltensweisen zur Gewohnheit machen, um Ihre Finanzen zu planen, sich Ziele zu setzen und sich einen Überblick zu verschaffen. Und das Gute ist, dass Ihnen alle nötigen Instrumente, um dies zu bewerkstelligen, hier zur Verfügung stehen.

Beherzigen Sie die folgenden 8 Ratschläge, um Ihre Finanzen in den Griff zu bekommen:

- Geben Sie weniger aus, als Sie verdienen.

- Verinnerlichen Sie das Konzept des Zinseszins.

- Informieren Sie sich über die verschiedenen Schuldenarten.

- Investieren Sie nur in Dinge, die Sie verstehen und die in Ihren Plan passen.

- Schützen Sie die Menschen, die Ihnen nahestehen.

- Vergewissern Sie sich, dass Sie sich mit Steuern auskennen.

- Informieren Sie sich über Ihre Arbeitnehmerleistungen.

Prendere il controllo della propria situazione finanziaria non deve essere complicato. Quando inizierai a gestire il tuo denaro, ti accorgerai di quanto possa essere remunerativo. Può aiutarti a tenere d’occhio le spese e a risparmiare. Gli ulteriori risparmi possono essere utilizzati per saldare eventuali debiti che potresti avere, oppure accantonati nei risparmi a lungo termine per far fronte ad una grossa spesa o addirittura per pianificare la prossima vacanza.

È facile, basta sviluppare sane abitudini per pianificare ed impostare degli obiettivi ed analizzare le tue finanze; la buona notizia è che proprio qui troverai tutti gli strumenti che ti possono dare una mano.

Ecco 8 sane abitudini che ti aiuteranno ad assumere il controllo delle tue finanze:

- Spendere meno di quanto guadagni

- Capire come funziona l’interesse composto

- Capire i tipi di debito

- Investire in ciò che comprendi ed avere un piano

- Proteggere chi ami di più

- Capire le tasse

- Capire le indennità offerte dal datore di lavoro

Reprendre le contrôle de votre situation financière n’est pas aussi compliqué que vous le pensez. Lorsque vous commencez à gérer votre argent, vous pouvez très rapidement en voir les bénéfices. Vous pourrez ainsi contrôler vos dépenses et réaliser des économies. Ces économies supplémentaires pourront servir à rembourser les dettes que vous pouvez avoir ou à compléter votre épargne à long terme pour une dépense plus conséquente ou encore simplement à organiser vos prochaines vacances.

Cela n’a rien de compliqué, il s’agit simplement de prendre des habitudes saines pour planifier, se fixer des objectifs et évaluer ses finances. La bonne nouvelle est que vous disposez de tous les outils nécessaires pour cela.

Voici les huit habitudes saines qui vont vous aider à prendre le contrôle :

- Dépenser moins que ce que vous gagnez

- Comprendre le fonctionnement des intérêts composés

- Comprendre les types de dettes

- Investir dans des produits que vous comprenez et avoir un plan

- Protéger vos êtres chers

- Comprendre la fiscalité

- Comprendre les avantages offerts par votre employeur

Prendere il controllo della propria situazione finanziaria non deve essere complicato. Quando inizierai a gestire il tuo denaro, ti accorgerai di quanto possa essere remunerativo. Può aiutarti a tenere d’occhio le spese e a risparmiare. Gli ulteriori risparmi possono essere utilizzati per saldare eventuali debiti che potresti avere, oppure accantonati nei risparmi a lungo termine per far fronte ad una grossa spesa o addirittura per pianificare la prossima vacanza.

È facile, basta sviluppare sane abitudini per pianificare ed impostare degli obiettivi ed analizzare le tue finanze; la buona notizia è che proprio qui troverai tutti gli strumenti che ti possono dare una mano.

Ecco 8 sane abitudini che ti aiuteranno ad assumere il controllo delle tue finanze:

- Spendere meno di quanto guadagni

- Capire come funziona l’interesse composto

- Capire i tipi di debito

- Investire in ciò che comprendi ed avere un piano

- Proteggere chi ami di più

- Capire le tasse

- Capire le indennità offerte dal datore di lavoro

Ihre Finanzen in den Griff zu bekommen, muss gar nicht kompliziert sein. Ein bewusster Umgang mit Geld kann sich buchstäblich für Sie auszahlen. Sie behalten den Überblick über Ihre Ausgaben und sparen Geld. Mit diesen zusätzlichen Einsparungen können Sie eventuell vorhandene Schulden tilgen, Sie können sie aber auch für ein langfristiges Sparziel oder den nächsten Urlaub zurücklegen.

Es ist ganz einfach, wenn Sie sich die richtigen Verhaltensweisen zur Gewohnheit machen, um Ihre Finanzen zu planen, sich Ziele zu setzen und sich einen Überblick zu verschaffen. Und das Gute ist, dass Ihnen alle nötigen Instrumente, um dies zu bewerkstelligen, hier zur Verfügung stehen.

Beherzigen Sie die folgenden 8 Ratschläge, um Ihre Finanzen in den Griff zu bekommen:

- Geben Sie weniger aus, als Sie verdienen.

- Verinnerlichen Sie das Konzept des Zinseszins.

- Informieren Sie sich über die verschiedenen Schuldenarten.

- Investieren Sie nur in Dinge, die Sie verstehen und die in Ihren Plan passen.

- Schützen Sie die Menschen, die Ihnen nahestehen.

- Vergewissern Sie sich, dass Sie sich mit Steuern auskennen.

- Informieren Sie sich über Ihre Arbeitnehmerleistungen.

Finansal durumunuzu kontrol altına almak karmaşık olmak zorunda değildir. Bütçenizi yönetmeye başladığınızda kaynaklarınız ihtiyaçlarınıza yetecektir . Gideriniz gelirinizden az olacak ve bu da sizi tasarrufa yönlendirecektir. Yapacağınız ekstra tasarrufla borçlarınızı ödeyebilir, uzun vadeli yatırımlara yönelebilir, hatta bir sonraki tatilinizi bile planlayabilirsiniz.

Durum basit! Yapmamız gereken finansal durumumuzu gözden geçirip, hedeflerimizi sağlıklı belirleyecek bir yaşam tarzını alışkanlık haline getirmektir.

- İşte ipuçları; Kazandığınızdan daha az harcama yapın

- Finansal işlemlerinizdeki hesaplamaları iyi analiz edinBorç kalemlerinizi gözden geçirin

- Yatırım yapmak konusunda bir planınız olsun ve bilmediğiniz araçlara yatırımlarınzı yönlendirmeyin

- Önceliklerinizi doğru belirleyin

掌控好您的財務並非很困難。財務控管能幫助您掌握日常開銷與花費,並建立儲蓄的習慣。有多餘的儲蓄還能用來償還其他的債務;一旦累積一段時間後,能用來支付大筆的開銷,甚至可以做為您下一段假期的旅遊金。

要想控制好您的財務很簡單,一切取決於良好的個人習慣包含規劃、設定目標和檢視財務狀況。好消息是您能運用這邊的工具/資源來幫助您做好財務的控管。

八個能幫助您掌握好財務狀況的良好習慣:

- 支出不大於收入

- 了解複利的效益與運作

- 了解負債的種類

- 在您可以承受風險的範圍內做投資並且有計畫地執行

- 保障那些您愛的家人

- 了解賦稅及優惠

- 了解您公司提供的福利

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

Go to https://sorted.org.nz/ for help and support and wide range of helpful articles and tools

The content of this article does not constitute individual financial advice. Aon can’t provide personalised investment advice or make personalised recommendations – we therefore suggest that you speak to an authorised financial adviser if you want to understand any of these concepts in the context of your personal situation.

Getting control of your financial situation doesn’t have to be complicated. When you start to manage your money, it can really pay off. It can help you stay on top of your spending and help you save. Extra savings can be used to pay off any debts you might have, or you can put them towards your long- term savings save for a large expense or even just plan your next holiday.

It’s simple, it’s all about developing healthy habits to plan, set goals and review your finances and the good news is you have all the tools right here to help you,

Here are 8 healthy habits that will help you get control ;

- Spend less than you earn

- Understand how compound interest works

- Understand types of debt

- Invest in what you understand and have a plan

- Protect those you love the most

- Understand tax

- Understand your employer benefits

Disclaimer: The information is brought to you by Aon Vietnam Limited with its Establishment and Operation License No. 26/GP-KDBH . Aon Vietnam Limited is a licensed insurance broker regulated by the Ministry of Finance in Vietnam. The information does not take into account the specific investment objectives, financial situation or particular needs of any particular person who may be in receipt of the materials. Accordingly, it should not be relied on or treated as a substitute for specific advice concerning individual situations. Please seek advice from a financial adviser regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs before you make a commitment to purchase an investment product. You are also recommended to obtain such other professional advice where appropriate. The information is provided in good faith and believed to be accurate as of the time of compilation. We do not undertake an obligation to update the materials or to correct any inaccuracy that may become apparent at a later time. You should always consult primary or more accurate or more up-to-date sources of information

Kiểm soát tình hình tài chính của bạn không hề phức tạp. Bạn nên bắt đầu ngay việc quản lý tiền bạc của mình, đây là việc nên làm. Việc này không chỉ giúp bạn có thể quản lý chi tiêu mà còn giúp bạn tiết kiệm. Khoản tiết kiệm có thể được sử dụng để thanh toán bất kỳ khoản nợ nào, hoặc bạn có thể bỏ thêm vào các khoản tiết kiệm dài hạn của mình để trả cho một khoản chi lớn hơn hoặc thậm chí lên kế hoạch cho kỳ nghỉ tiếp theo của mình.

Việc này cực kỳ đơn giản, tất cả bạn phải làm đó là hướng tới việc phát triển các thói quen lành mạnh, để lập kế hoạch, đặt mục tiêu và xem xét tài chính của mình, và tin tốt là bạn có tất cả các công cụ ngay tại đây để giúp bạn,

Dưới đây là 8 thói quen lành mạnh sẽ giúp bạn kiểm soát;

- Chi tiêu ít hơn số tiền bạn kiếm được

- Hiểu cách hoạt động của lãi kép

- Hiểu các loại nợ

- Đầu tư vào những gì bạn hiểu và có kế hoạch

- Bảo vệ những người bạn yêu thương nhất

- Hiểu về thuế

- Hiểu về quyền lợi của chủ lao động

Tuyên bố miễn trừ trách nhiệm: Thông tin này được cung cấp bởi Công ty TNHH Aon Việt Nam với Giấy phép Thành lập và Hoạt động số 26/ GP-KDBH. Công ty TNHH Aon Việt Nam là công ty môi giới bảo hiểm được cấp giấy phép dưới sự quản lý của Bộ Tài chính tại Việt Nam. Các thông tin này không tính đến các mục tiêu đầu tư cụ thể, tình hình tài chính hoặc nhu cầu riêng biệt của bất kỳ đối tượng cụ thể nào nhận được tài liệu này. Theo đó, bạn không nên dựa vào hoặc coi tài liệu này như một phương thức thay thế cho sự tư vấn riêng biệt liên quan đến các tình huống cụ thể. Vui lòng tìm kiếm sự tư vấn từ chuyên gia cố vấn tài chính về sự phù hợp của bất kỳ sản phẩm đầu tư nào có tính đến các mục tiêu đầu tư cụ thể, tình hình tài chính hoặc nhu cầu riêng biệt của bạn trước khi bạn cam kết mua sản phẩm đầu tư. Bạn cũng nên có được sự tư vấn chuyên biệt khác khi cần thiết. Thông tin này được cung cấp dựa trên sự trung thực và được cho là chính xác vào thời điểm biên soạn. Chúng tôi không có nghĩa vụ phải cập nhật các tài liệu hoặc sửa chữa bất kỳ thông tin không chính xác nào là những thông tin được làm rõ sau này. Bạn luôn cần phải tham khảo các nguồn thông tin chính hoặc các thông tin chính xác hơn hoặc cập nhật hơn.

การควบคุมสถานการณ์ทางการเงินของคุณไม่ใช่เรื่องยุ่งยากเสมอไป เมื่อคุณเริ่มจัดการการเงินของคุณ ผลลัพธ์จะเกิดขึ้นได้จริง การจัดการการเงินจะช่วยให้คุณรู้จักควบคุมการใช้จ่ายและช่วยให้คุณประหยัดได้ เงินออมเพิ่มเติมสามารถนำไปชำระหนี้ที่คุณมีอยู่ หรือคุณสามารถนำไปรวมในการออมระยะยาวของคุณที่สะสมไว้สำหรับค่าใช้จ่ายก้อนใหญ่ หรือแม้แต่วางแผนวันหยุดครั้งต่อไปของคุณ

การจัดการการเงินเป็นเรื่องที่เรียบง่าย ทุกอย่างเกี่ยวกับการพัฒนานิสัยที่ดีในวางแผน กำหนดเป้าหมายและทบทวนการเงินของคุณ และข่าวดีคือคุณมีเครื่องมือทั้งหมดอยู่ตรงนี้เพื่อช่วยคุณ

นี่คือ 8 นิสัยที่ดีที่จะช่วยให้คุณควบคุมได้

- ใช้จ่ายให้น้อยกว่ารายได้

- เข้าใจว่าดอกเบี้ยทบต้นทำงานอย่างไร

- เข้าใจประเภทของหนี้สิน

- ลงทุนกับสิ่งที่คุณเข้าใจและมีการวางแผน

- ปกป้องคนที่คุณรักมากที่สุด

- เข้าใจเรื่องภาษี

- เข้าใจสวัสดิการจากนายจ้างของคุณ

Det behöver inte vara komplicerat att ta kontrollen över sin ekonomiska situation. Det kan verkligen löna sig att få mer kontroll över pengarna. Det kan bidra till att du kan hålla koll på dina utgifter och hjälpa dig att spara. Extra besparingar kan användas för att betala av eventuella skulder eller så kan du öronmärka dem för ett långsiktigt sparande till en stor utgift eller bara för nästa semester.

Det är enkelt. Allt handlar om att utveckla sunda vanor som hjälper dig att planera, sätta upp mål och se över din ekonomi – och de goda nyheterna är att du redan har alla verktyg du behöver.

Här är åtta sunda vanor som hjälper dig att ta kontroll:

- Spendera mindre än du tjänar

- Förstå hur ränta på ränta fungerar

- Förstå olika typer av skulder

- Investera i det som du förstår och ha en plan

- Skydda dem som står dig närmast

- Förstå skatt

- Förstå dina anställningsförmåner

Mengatur kondisi keuangan Anda tidak harus rumit. Ketika Anda berusaha mengelola keuangan, hasilnya bisa sangat memuaskan. Mengelola keuangan bisa membantu Anda mengatur pengeluaran dan membantu Anda menabung. Tabungan ekstra bisa digunakan untuk membayar utang jika Anda punya, atau Anda bisa menambahkannya ke tabungan jangka panjang Anda untuk pengeluaran yang lebih besar, atau untuk liburan selanjutnya.

Sederhana saja, ini semua tentang mengembangkan kebiasaan sehat untuk merencanakan, menetapkan tujuan, dan meninjau keuangan Anda dan kabar baiknya adalah semua alat di sini bisa Anda akses untuk membantu Anda.

Berikut adalah 8 kebiasaan sehat yang akan membantu Anda mengatur;

- Gunakan lebih sedikit dari penghasilan Anda

- Pahami cara kerja bunga majemuk

- Pahami jenis-jenis utang/pinjaman

- Berinvestasilah pada apa yang Anda pahami dan buat rencana

- Lindungi orang-orang yang paling Anda cintai

- Pahami perpajakan

- Pahami tunjangan perusahaan Anda

Penulis bukan konsultan keuangan, konsultan pajak, atau konsultan hukum. Artikel dan isinya hanya untuk tujuan informasi, pembaca tidak disarankan untuk menafsirkan informasi atau material lain apa pun sebagai saran hukum, perpajakan, investasi, finansial, atau saran lain. Semua informasi, data, strategi, laporan, artikel, dan semua fitur lain dari artikel ini disediakan untuk tujuan informasi dan edukasi semata dan tidak seharusnya dianggap atau ditafsirkan sebagai saran investasi personal untuk pembaca. Mungkin ada kesalahan pada artikel ini, dan pembaca sebaiknya tidak mengambil keputusan finansial atau investasi berdasarkan apa yang mereka baca dalam artikel dan tulisan ini saja. Merupakan tanggung jawab pembaca untuk melakukan uji tuntas mandiri dan pembaca harus mengambil keputusan sendiri. Pahamilah dan berhati-hatilah karena keputusan keuangan dan investasi mengandung risiko. Penulis tidak bertanggung jawab atas kerugian langsung maupun yang timbul akibat penggunaan tulisan, produk, layanan, situs, atau konten lain yang ditulis oleh penulis, termasuk konten artikel ini. Pembaca bertanggung jawab atas penelitian dan keputusan investasinya sendiri. Pembaca sebaiknya meminta saran penasihat keuangan yang berkualifikasi dan sepenuhnya memahami semua risiko sebelum berinvestasi atau mengambil keputusan finansial apa pun. Penulis tidak menjamin bahwa pembaca akan atau memperoleh hasil sebagaimana yang dikutip dalam artikel ini. Semua hasil rekomendasi penulis tidak didasarkan pada investasi aktual yang dilakukan sendiri oleh penulis dan didasarkan pada hipotesis, statistik, serta survei yang ada, yang memiliki batasan dan tidak mencerminkan semua komponen investasi sesungguhnya. Hasil nyata yang diterima pembaca mungkin berbeda-beda disebabkan berbagai faktor. Semua konten dan referensi sumber pihak ketiga disediakan semata-mata untuk kemudahan. Informasi ini mungkin tidak akurat, gunakan dengan penuh tanggung jawab. Dengan membaca artikel ini atau isinya, Anda setuju bahwa baik penulis maupun karyawannya, pemegang saham, direktur, kontraktor, afiliasi, agen, penyedia konten pihak ketiga, atau pemberi lisensi tidak akan bertanggung jawab atas segala bentuk klaim, tanggung jawab, biaya, kerusakan, atau kerugian, langsung, tidak langsung, maupun insidental akibat penggunaan bagian konten ini oleh pembaca. Termasuk, namun tidak terbatas pada, kerugian atau cedera yang semuanya atau sebagian disebabkan oleh kemungkinan di luar kendali kami.

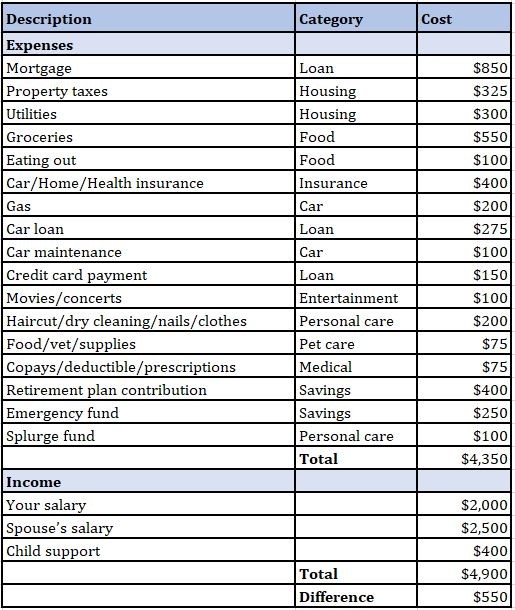

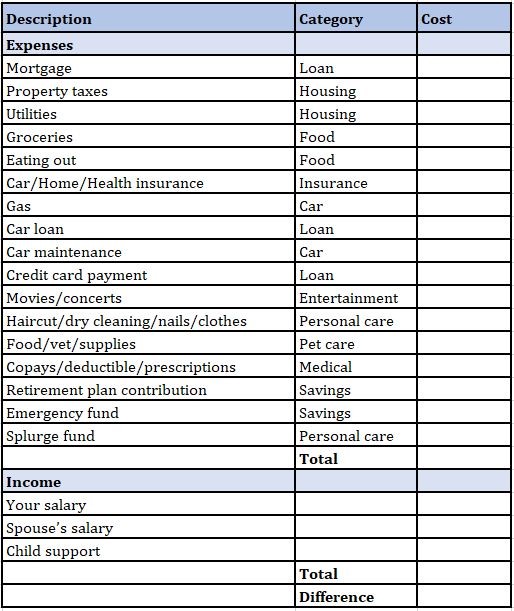

Budgeting is a tool that works when it comes to helping you manage your finances successfully. While it can seem overwhelming to even think about getting more organized financially, let alone tracking your spending, budgeting is a tool that works for individuals, businesses and governments alike. Budgeting is a way to get your financial life under control that can yield many benefits.

Why Budgets Matter

Budgets don't have to be complicated. Even the simplest guidelines around spending can make the difference between financial solvency and getting into too much debt. People who make and stick to budgets tend to have more savings, less debt, and to feel better about their financial situations. Creating a budget is a worthwhile endeavor no matter what your financial situation is—even the very wealthy, who would seem to be the last people who would need a spending plan, create and stick to budgets.

Even a simple budget can help pave the way to financial success.

Budgeting involves creating a plan so that expenses match income.

Even wealthy people craft budgets as a way to ensure they don't spend too much.

Simple budgeting is worthwhile

Without a budget, it is all too easy not to have any idea how much money you and your family are spending and where that money is going. And without some idea of what you are spending money on, from a mortgage payment to groceries to utilities to day care, you risk running out of money before all your bills are paid.

Budgeting is no more and no less than creating some kind of plan so that what you spend equals what you make or what you and your spouse or partner make. When you budget, you take a look at any income you have that comes in, which could include any salary you or your partner make from working, and other income, which might include child support or alimony.

Then you look at your expenses and do your best to ensure that what you spend doesn't exceed your income. Ideally, your spending should be less than your income so you have money to save for emergencies, retirement and other life goals. But even if that isn't the case at first, creating a simple budget is the first step.

Creating a budget and sticking to it gives you the ability to come out ahead financially. By knowing what you spend money on and matching your expenses with your income, you'll gain financial security and the emotional security of knowing that you can meet your financial obligations.

Even rich people have budgets

People of every income group can benefit from budgeting. That's why many wealthy people track their spending and create and stick to budgets.

In this respect, wealthy people aren't any different from you or me. They want to be able to meet their financial goals and unless they know what they are spending and how their income is being deployed, they are at risk of spending more than their income and not meeting those financial goals.

A wealthy person's budget is going to be similar to the budget of someone who doesn't make very much money. They may have more bills, and those bills are likely to be larger, but expenses are expenses, and for a rich person to save any money, they must also spend less than their income. Otherwise, they will get into debt and may end up having financial problems.

Preparing to Budget

When you think about budgeting as a positive rather than a negative, it's easier to make the time to build at least a simple spending plan. That's because budgeting can set you free from worrying about your finances and from getting into debt over your head. Budgeting is a tool designed to help you feel better about your finances by understanding what you are spending and helping you better match that spending with your income.

Budgeting has many positive benefits.

A budget should have some extra money for occasional splurges.

Budgeting realistically helps a budget be more successful.

Preparing for budgeting

Before you begin to build a budget, there are some issues to consider. Firstly, it's very important to distinguish between what you want and what you need in your budget. Budgeting is focused on meeting your financial needs and some of your wants, but the needs have to come first.

Financial needs include paying for housing, utilities, food, transportation and other basics. Financial wants include things that you'd like to have, which could include anything from a sports car to a designer purse to a daily stop at your favorite coffee shop.